what is net income attributable to noncontrolling interests

What is Non-Controlling Interest?

Non-controlling interest refers to the minority shareholders of the company who own less than fifty% of the overall share capital and therefore doesn't have command over the decision-making process of the company.

By and large, in the instance of publicly traded companies, well-nigh of the shareholders are minority shareholders, and just promoters could be categorized equally majority or decision-making shareholders. In example of consolidation of accounts, the amount attributable to minority, based on net assets value, is shown separately as a Not-controlling interest in the Balance Sheet reserves and a surplus of the entity.

You are free to use this image on your website, templates etc, Please provide us with an attribution link Commodity Link to be Hyperlinked

For eg:

Source: Non-Controlling Interest (wallstreetmojo.com)

Non-Controlling Interest Types

In that location are 2 types – Direct and Indirect.

#1 – Direct

It is one where the minority shareholders Minority interest is the investors' stakeholding that is less than 50% of the existing shares or the voting rights in the company. The minority shareholders practice not have command over the company through their voting rights, thereby having a meagre role in the corporate decision-making. read more get their share in the recorded equity of the subsidiary visitor A subsidiary company is controlled by some other visitor, better known as a parent or property company. The control is exerted through buying of more than fifty% of the voting stock of the subsidiary. Subsidiaries are either prepare up or acquired by the controlling company. read more . All recorded equity hither means both pre and mail service acquisitions amounts.

For Case:

Visitor B has reserved as on 31.03.2018, accumulation to $ 550,000. On 01.04.2018, Mr. X bought x% shares of company B. Since it is a example of Direct Non-decision-making interest, Mr. X would be entitled to 10% of pre-existing/by profits of Company B, in addition to the futurity profits accruing mail service 01.04.2018.

#2 – Indirect

It is i where the minority shareholders receive a proportionate allocation of post-acquisition profits but, i.e., he would non receive a share in the pre-existing profits of the company.

For Example:

Company A holds xx% shares in Visitor B, company A also acquired threescore% shares of Visitor P, which holds 70% of the shares of Company B. Thus, the shareholding of Company P and Company B would look as nether, mail-conquering:

Company P:

- Shares held by Company A: sixty%

- Direct Non-controlling involvement: 40%

Company B:

- Shares held by Visitor A: 62%

- Direct Non-controlling interest: forty%

Indirect Not-controlling interest: It is calculated using the direct involvement on Residual Canvass of P ltd, i.eastward., 40% * lxx% = 28%

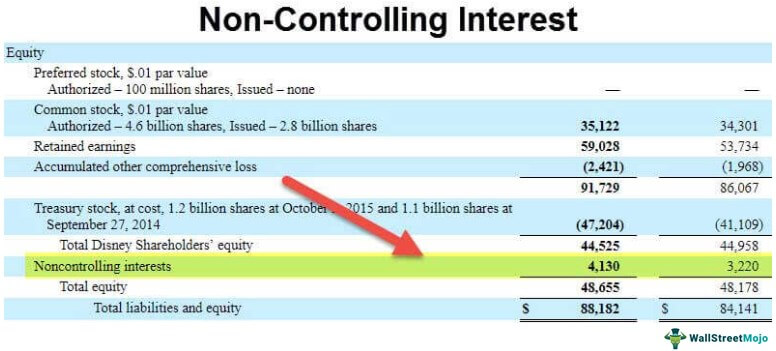

Bookkeeping for Non-controlling involvement on Rest Sheet

Bookkeeping for minority involvement comes into moving picture while consolidation of books of accounts by the holding company A belongings company is a company that owns the majority voting shares of some other company (subsidiary company). This company also mostly controls the management of that company, besides as directs the subsidiary's directions and policies. read more . Consolidation refers to the procedure by which financial statements of two or more companies are combined to grade one set of financials.

Consolidation is applicable when an entity holds the bulk stake in another entity, which is known as the subsidiary entity. Every bit Consolidation combines 2 or more than two sets of fiscal statements, it allows the stakeholders, such as investors, creditors, lenders, etc. to view the combined financial statements of all the three entities as if that was one entity.

While consolidating the fiscal statements Consolidated Financial Statements are the financial statements of the overall grouping, which include all three cardinal financial statements – income statement, cash flow statement, and balance canvass – and correspond the sum total of its parents and all of its subsidiaries. read more than of the subsidiary company with the belongings company, the net assets value of the shared held past the minority shareholders is recognized as a Minority involvement in the reserves and surplus in the consolidated fiscal statements.

Instance #1

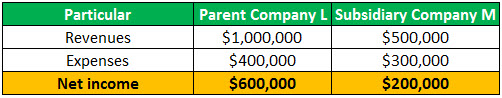

Company 50 acquired 85% of the shares outstanding Outstanding shares are the stocks available with the company's shareholders at a given point of time subsequently excluding the shares that the entity had repurchased. It is shown every bit a part of the owner's equity in the liability side of the company's balance sheet. read more of Visitor M. Thus, the remaining shares held by minority shareholders were 15%. At the terminate of the twelvemonth, Company M reported revenues of $ 500,000 and expenses of $ 300,000, whereas Company L reported revenues of $ i,000,000 and expense of $ 400,000.

Net income of Company L and Thousand tin be computed as nether:

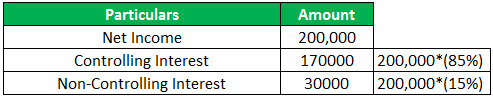

Allotment of cyberspace income of Company M, between decision-making and not-controlling interest, is as under:

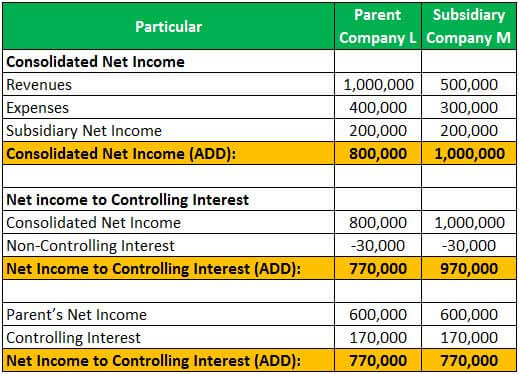

Consolidated cyberspace income can be computed equally under:

Example #2

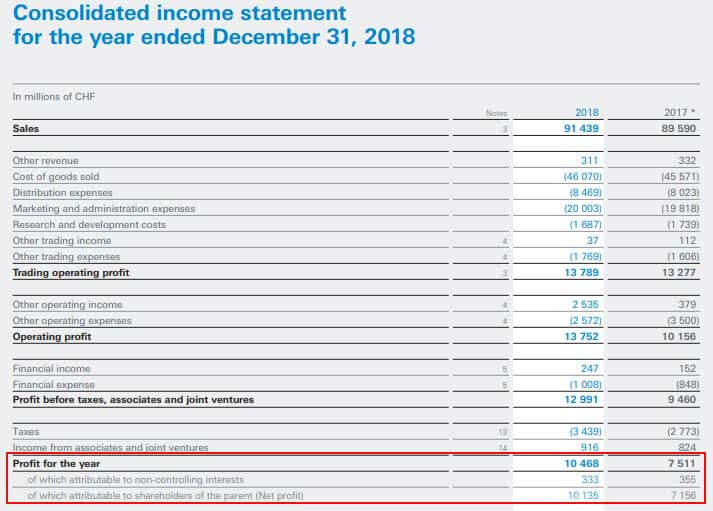

The following extract is from the Fiscal statements of Nestle for the yr ended 31st December 2018, which shows the profit is attributed to the non-controlling interest and shareholders of parent:

Following is the extract of the consolidated remainder sheet of Nestle which shows the amount owing to Non-decision-making involvement:

Source: world wide web.nestle.com

Information technology thus represents the corporeality attributable to shareholders who are not the significant shareholders of the company and accept no authority of conclusion making in the company. The amounts owing to NCI are shown separately in the consolidated financial statements, as it is the corporeality that doesn't vest to the parent entity and is attributable to minority shareholders.

Recommended Articles

This article has been a guide to What is Non-Controlling Interest and its Definition. Hither we discuss the two types of not-controlling involvement on the balance sheet and its accounting while consolidating the books with examples. You lot can learn more nigh bookkeeping from the following articles –

- Return on Net Assets

- Controlling Interest Example

- What is Class A Shares?

- Nominal Value of Shares

thomassoneacce1976.blogspot.com

Source: https://www.wallstreetmojo.com/non-controlling-interest/

Post a Comment for "what is net income attributable to noncontrolling interests"